Read more about InAlienable.Support Quixote Center’s InAlienable program!

InAlienableDaily Dispatch

October 3, 2019

Five of the biggest financial corporations in the world can’t stomach funding the private corporations that profit from incarcerating immigrants anymore - and yet, the U.S. government still wants to give those same private corporations lots of your money. From Forbes:

All of the existing banking partners to private prison leader GEO Group have now officially committed to ending ties with the private prison and immigrant detention industry. These banks are JPMorgan Chase, Wells Fargo, Bank of America, SunTrust, BNP Paribas, Fifth Third Bancorp, Barclays, and PNC.

This exodus comes in the wake of demands by grassroots activists — many under the banner of the #FamiliesBelongTogether coalition — shareholders, policymakers, and investors. Major banks supporting the private prisons behind mass incarceration and immigrant detention have now committed to not renew $2.4B in credit lines and term loans to industry giants GEO Group and CoreCivic.

This shift represents an estimated shortfall of 87.4% of all future funding to the industry, which depends on these bank credit lines and loans to finance their day to day operations.

While capitalism functions on debt in general, GEO Group and CoreCivic are particularly vulnerable here. Both companies, which between them control 75 percent of the private prison market, are #e8002626caa1">registered with the Internal Revenue Service as Real Estate Investment Trusts. One of the requirements of REITs is that 90 percent of company income must be delivered to shareholders in dividend payments. This means more value for shareholders and the REIT designation means lower taxes - and bigger profit for the companies. It also means there is less cash on hand for day-to-day operations, and thus, compared to other corporate structures, a greater dependence on regular infusions of money from new borrowing.

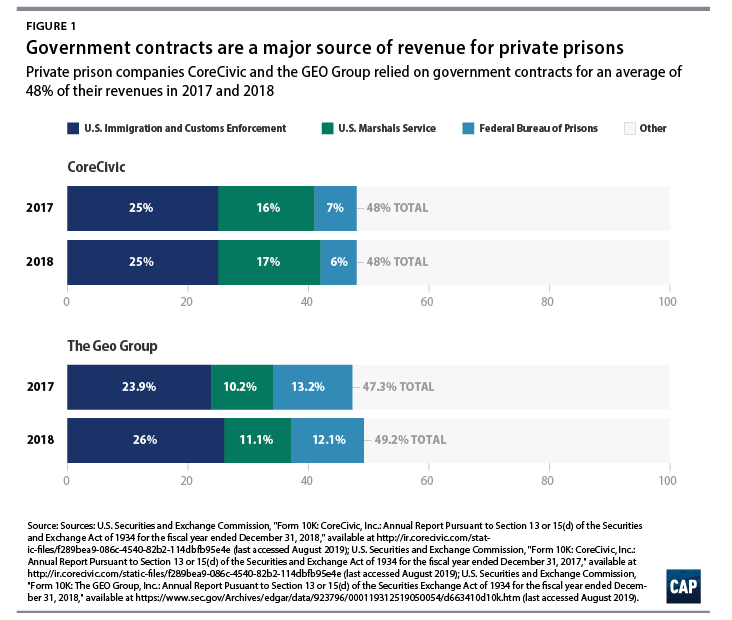

As both GEO Group and CoreCivic operate contracts with the Federal government that guarantee them bed space and thus income, this has not been a challenge until recently. Indeed, from 2009 until 2017, Congress required that a daily minimum average of 34,000 people be held in detention - a requirement that translated into a guarantee of hundreds of millions of dollars to both companies. By the time this minimum was dropped the daily average number of detainees had reached 40,000 - and has skyrocketed since. Outside of the legislative process, minimums are written into individual contracts as well, minimizing risk to the companies. At the end of 2017, for every 100 people in detention, 32 were in a GEO Group managed facility and 21 were in a CoreCivic facility.

Then came Trump’s war on immigrants. Both companies saw the bottom line benefits to their work in Trump’s campaign rhetoric, and each gave $250,000 to his inaugural committee. Both have been paid back many times over in new contracts. However, as daily news about the horrible conditions that people are detained in (the conditions themselves have been horrible for many years prior to Trump), public pressure against detention has increased. The current media environment combined with savvy campaigners ready to go after the money flow to stop GEO and CoreCivic led to effective calls for banks to cut financial ties with the prison industry. And it is obviously working.

Meanwhile, the Federal government wants to detain even more immigrants, and, for now, this means giving GEO Group and CoreCivic more money. As we write, Trump is requesting an expansion of detention funding for next year to 52,000 beds a night from the current 45,000 (a budget limit this administration blew early in the fiscal year). Indeed, Immigration and Customs Enforcement was holding 55,000 people in August. GEO Group and CoreCivic won’t receive all of this increase - but they will get a healthy chunk of it, as they have already benefited from Trump’s expansion of new facilities in Louisiana and Mississippi over the past year.

How slimy are these companies? Consider the GEO Group. In 2016 a Texas court blocked GEO Group and CoreCivic from registering as child care providers with the Texas Department of Family and Protective Services. Such a designation would have allowed the companies to detain immigrant families with children indefinitely. In response, a GEO Group lobbyist worked with a member of the Texas legislature to introduce a bill to weaken child care licensing requirements. The new bill did not pass, but the effort illustrated the reach of the company’s lobbying efforts at the state level (private prison companies spent a quarter of a million dollars or more lobbying the Texas legislature that session), not to mention the utter lack of moral accountability that guides their business decisions. Outside of a small state-run facility in Pennsylvania, all of the government’s current family detention capacity is in Texas and run by either CoreCivic or the GEO Group. Not long after the Texas decisions, Trump’s administration promoted changes in the Flores Settlement Agreement that would allow the government to license its own facilities. A federal judge just shot that down on Friday.

The irony is that JPMorgan, Barclays and Bank of America, who collectively helped sink the global economy behind fraudulent lending practices in 2008 and suffered not one indictment between them, now find it is not in their interest to be associated with the immoral practices of the private prison industry. The U.S. government, however, is all too happy to stand with these companies - using your money. Indeed, to pay for its overspending on immigrant incarceration the Department of Homeland Security had to raid other accounts from the Coast Guard to FEMA this year.

On the one hand there is nothing shocking about this. Everyday the U.S. government hands out billions of tax dollars to really horrible companies that do everything from hold children in immigrant detention facilities to build the bombs that were dropped on those kids homes thereby forcing them to become immigrants in the first place. But there is something particular maddening about the dense layers of hypocrisy that buttress the U.S. government’s policy of immigrant detention and mass incarceration more generally. None of it is necessary. The people in ICE detention are not there on criminal charges. They are awaiting determination of their immigration status. If let out of detention, people will show up for their immigrant court cases. Under community supervision, well over 90 percent do. If one steps back and looks at the entire edifice of the criminalization of migration, detention serves no purpose outside of the value it gives to political posturing and private companies’ stock margins.

For now GEO Group and CoreCivic are feeling the pinch. There is legislation before congress that would phase out the use of private companies (the Dignity for Detained Immigrants Act) and nearly every Democrat running for president supports ending private prison company involvement in immigrant detention (and by extension, for federal incarceration). For now, however, that legislation is not moving and Trump is still president. With current income streams in place, one broker, at least, expects GEO Group’s stock to significantly rebound from its current low over the next 12 months. If it does, it will only be because our government has a weaker moral compass than Wall Street. Sobering.

Postscript: On October 1st, the first day of the fiscal year 2020, a man from Cameroon died in Otay Mesa Detention Center in San Diego after experiencing a brain hemorrhage during a “hypertensive event.” Otay Mesa is operated by CoreCivic.